In more and more countries around the world, individuals and organisations are raising their voices to demand the reduction or elimination of unfair taxes on menstrual products. And more and more governments are listening and taking action. This website provides an overview of past and present national campaigns and shares key lessons learned from around the world. Our goal is to support ongoing campaigns with learnings and ammunition for advocacy, and to inspire more action on the issue.

For a national campaign to be successful, it is critical to understand the different arguments for and against reducing or scrapping period taxes. While there are similarities, every country has its distinct legal, political and tax framework. Before starting a campaign, it is absolutely crucial to think through how period taxes can effectively be changed within your country’s specific settings.

Explore our case studies to learn about the dos and don’ts of campaigning against period taxes! Get inspired by creative examples of how campaigners advocated for a change in period taxes.

Read a summary of our web talk that brought researchers, journalists, and activists together to discuss the status and outlook of the period tax movement worldwide.

There are four key reasons why it’s important to campaign against unfair taxes on menstrual products:

Existing and previous period tax campaigns offer a wealth of knowledge, experience and inspiration!

Menstrual products are basic necessities and should be taxed as such. But in many countries, they are not! For some people, this makes menstrual products unaffordable.

Lowering taxes may lead to lower product prices, but this is not always the case. We explain some of the background aspects that influence if the tax reduction will be passed on to consumers and provide tips for your period tax campaign.

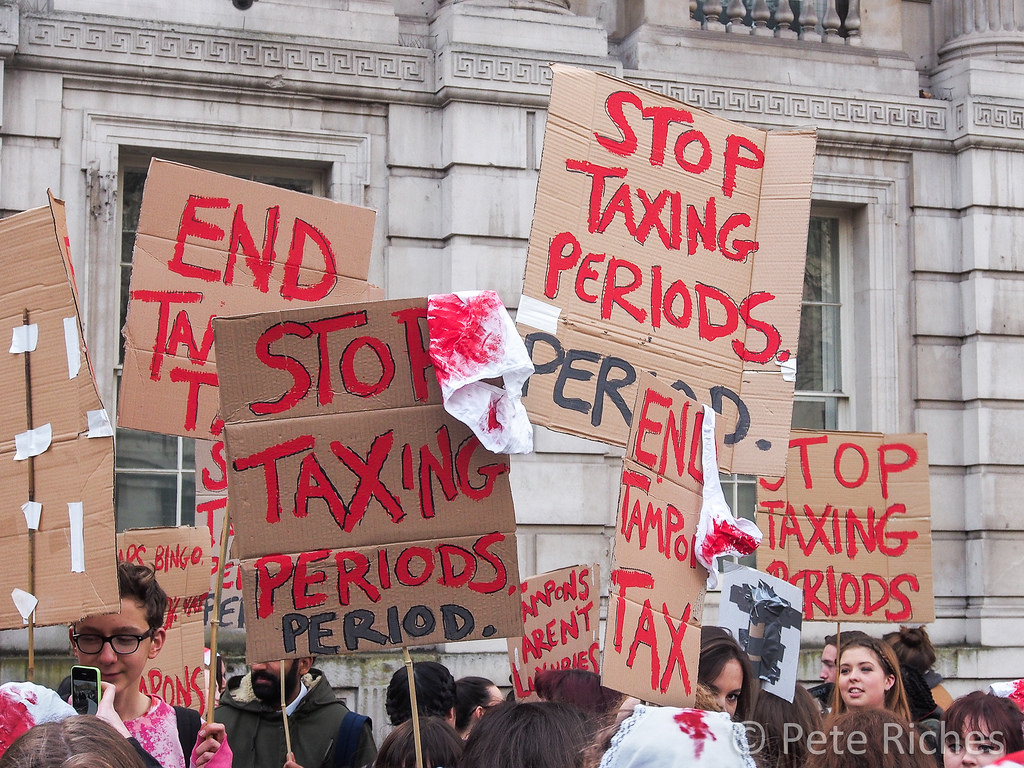

Activists all over the world call for the reduction or elimination of taxes on menstrual products, because they are basic necessities and should be taxed as such. The good news is that more and more countries have implemented tax changes as a result.

Here are our top ten tips for campaigning against period taxes. It’s all about a bloody good strategy!

Taxation can be complicated, so this video aims to help you better understand the different tax aspects of menstrual products. We start with some key terms that are often used in campaigns. In the second part, we explain how tax is applied to menstrual products, and what different tax rates mean for the final consumer price.

Learn more about the topic of period taxes and campaign examples through these explanatory videos.

Click images to start the videos.

Our Advocacy Guide provides you with key insights from period tax campaigns around the world and helps you to plan and implement a period tax campaign. Our Research Report helps you understand opportunities and pitfalls when it comes to ensuring that tax reductions result in decreased retail prices of period products