This interview is with Shanice Britz, Assistant Project Manager at Women’s Action for Development (WAD) Namibia, who led the #Taxfreeperiodnam campaign.

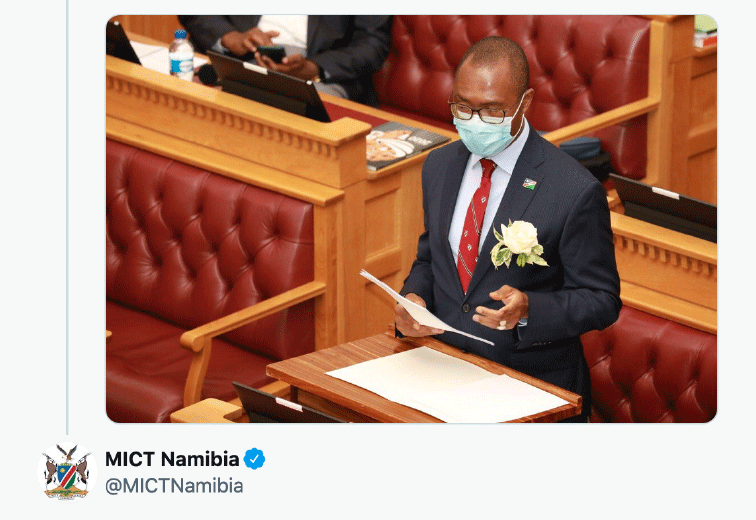

On 3rd March 2021, the Namibian Deputy Minister of Information and Technology (MICT) tabled a motion in the National Assembly seeking the amendment of tax laws to allow for a tax exemption on all menstrual hygiene products. The motion was approved on 17th March 2021 and will go into effect in the 2022/2023 financial year.

In 2019, period brand einhorn and the magazine NEON launched an additional petition to the Petitions Committee of the German parliament. This petition reached the necessary 50,000 signatures, so the Petitions Committee invited einhorn and NEON to discuss the issue of reducing VAT on period products to 7%.

The campaign ran from September to December 2020.

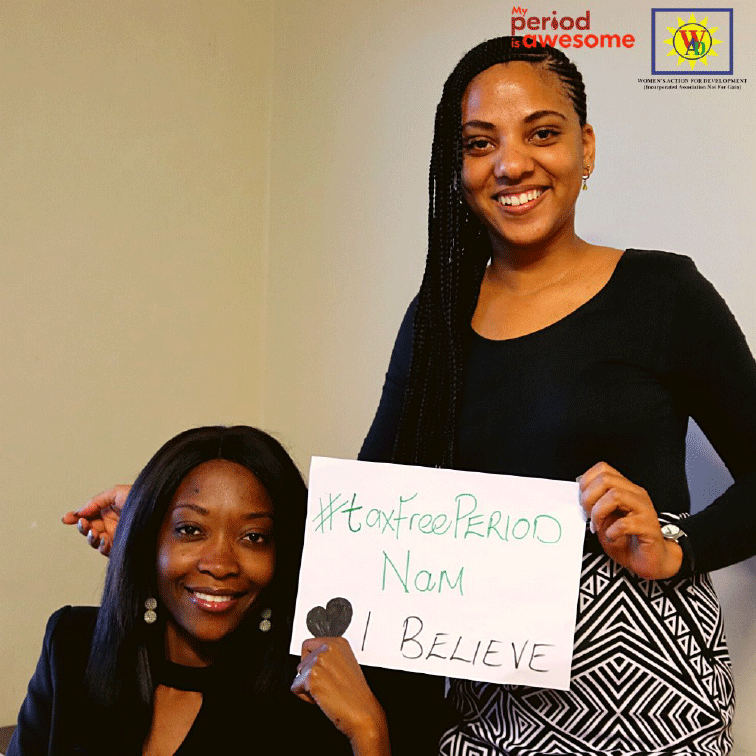

The campaign came about when we started a project with “My Period is Awesome” (a Swedish organisation). Our goal was educating young girls and boys in local schools. Based on feedback from these trainings, we found that many young girls cannot afford sanitary pads and made use of other unsafe alternatives. Menstrual products are a basic need and should be treated as such.These products shouldn’t be taxed.

Our campaign was online. We created the hashtag #taxfreeperiodnam and used our social media platforms. We also started an online petition to get the word out. The petition was signed by more than 11,000 people. This was a big milestone.

We wrote letters of support to parliamentarians and chief whips of political parties to support and lobby for this in parliament. We got a positive response from SWAPO, the current ruling party, and the motion was tabled in Parliament.

Our campaign was featured in several local newspapers, radio interviews, and we were on our National Broadcasting Cooperation, on the “Good morning, Namibia Show”, where we raised awareness about the importance of removing tax from menstrual products. We worked with our project ambassador, Chikune, who is an artist, musician, and a local doctor. Her participation brought a lot of attention to the campaign online. That was another milestone! We also created a short clip with colleagues including Chikune, promoting the campaign.

Shortly after our online petition ended in December 2020, we continued to campaign for the exemption of sanitary products from VAT.

WAD participated in a consultative meeting with the Minister of Finance, organized by the Institute of Public Policy Research (IPPR), where the Minister requested Civil Society Organisations to suggest issues they would like to feature in his budget statement for 2021/2022. The WAD Executive Director lobbied the Minister to consider exempting sanitary products from VAT. The Minister eventually included WAD’s proposal in his budget speech. Furthermore, we engaged several lawmakers and the Chief Whip of the ruling party invited us to his office for further deliberations, where he indicated his strong support for the campaign and promised to engage his colleagues in parliament to table the matter for discussion in the National Assembly. This we regard as one of the key ingredients to our success since the ruling party enjoys quite a majority representation in parliament.

The campaign attracted media interest from as far as South Africa. On the other hand there was influence from South Africa as well. (Note: A price change is not yet observable, as the tax will come into effect on 2022/23, but WAD promises to monitor this.)

“Following on our extensive consultation with the civil society (...), I wish to announce that the supply of sanitary pads will be VAT zero-rated to enhance affordability by the girl child. I urge suppliers and retailers to pass on this relief to consumers once enacted,”

Extract from the Minister of Finance - Ipumbu Shiimi’s FY2021/22 Budget Statement

Since the announcement, the issue around period poverty became a topic of discussion in all walks of life. The removal spotlighted the actual reality of period poverty in the country. Afterwards, a lot of organizations, movement groups, businesses and corporates started to reach out and donate resources.Ultimately, we want free sanitary products for women and girls in public places, hospitals, workplaces, clinics, and schools. This is the goal and tax removal is just a start!

(Note: A price change is not yet observable, as the tax will come into effect on 2022/23,but WAD promises to monitor this)

Collaborate and share ideas with other organisations.

Just before you kick off the campaign, do research, find out who has done similar work and try to collaborate. There are organisations and individuals who might not be doing exactly what you are doing, but they are in the same field and by working with them, you can have a greater impact and a greater voice.

Social media is powerful.

Make use of available resources that are free, such as social media, as it is a great tool to get your message out and lobby for your campaign.

Listen to voices of people you are campaigning for and make them heard.

If you are campaigning for people, especially for the voiceless, it is always good and fair to speak to the women and girls who don’t have access to menstrual products. They can tell you, “This is our problem; this is the solution we’d like to see and want”. Learn from them and relate this back to the people you want to impact.

Do acknowledge previous work

We only found out after we kicked off, about previous efforts and that there were other people who spoke about this in Parliament, and we got a bit of backlash because we did not acknowledge it. Include that information in your campaign, “this was done then, this was the result”. Give credit where it’s due.

WAD team met with Hon. Hamunyera Hambyuka (SWAPO Chief Whip) to discuss preparations for TABLING OF MOTION ON VAT FREE SANITARY PRODUCTS in the National Assembly

Learn more about Women’s Action for Development (WAD) Namibia, https://wad.org.na/