Whether you are a small group of individuals or a coalition of organisations, if you are about to get started or already have made some headway with your campaign, this website offers a wealth of data on period taxes, learnings from other campaigns and other resources to help you achieve your campaign goals.

For in-depth guidance on how to plan and implement a campaign on period taxes, please read our Advocacy Guide.

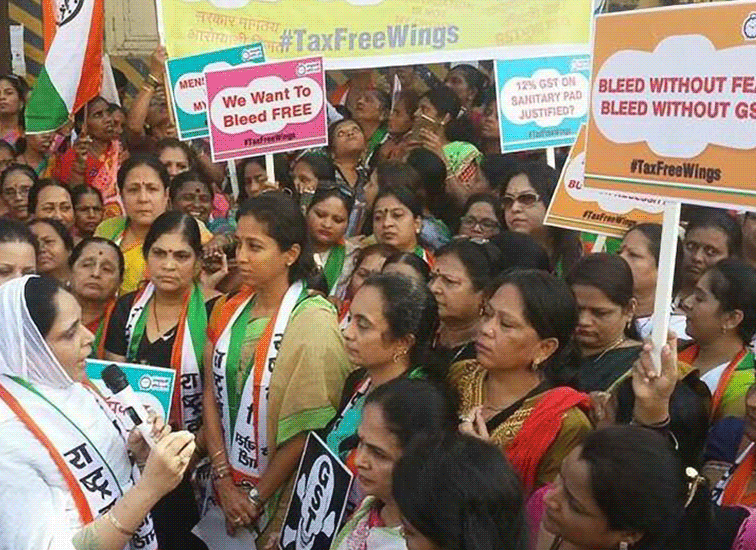

Get inspired by these creative examples of how campaigners advocated for a change in period taxes.

Zum Beispiel Video Nr. 1 für Why Scrap Taxes Subpage

When you campaign for change it is normal to experience some resistance. Here is a list of counter arguments that are commonly brought up against campaigns for tax removal or reduction and how to respond to them.

When considering individual products, taxes account for a small fraction of the price. But counted over a year or over a woman's lifetime, it adds up to a significant sum of money, especially for poorer women and girls. In addition to the financial aspect, the tax is a manifestation of gender inequality and discrimination against women and girls.

Campaign tip: Draw attention to the fact that period taxes are unfair and gender discriminatory, no matter how high or low they are.

Yes, in many countries the removal or reduction of period taxes alone does not necessarily lead to lower product prices. But the fact that it requires additional action doesn’t mean that it is impossible. Ideally, the government and the public will hold producers and retailers accountable and pressure them to pass through tax reduction to consumers. In addition, lower product prices are just one positive effect of tax reduction, alongside triggering broader conversations about gender equality and tackling persisting stigma surrounding menstruation.

Campaign tip: As part of the campaign, get suppliers and retailers to publicly commit to passing the tax reduction through to consumers. If they do, this will help you increase pressure on political decision makers and enable you to hold suppliers and retailers to account. Consider campaigning for products to be zero rated instead of tax exempt if this is possible within your country’s tax system. Read more about this in the Research Report.

Very poor people may still not be able to afford menstrual products even if a tax reduction or removal is passed on to consumers. To ensure access for all, further measures may be required that can also be complementary to a tax change.

Campaign tip: If the campaign aims to address period poverty, consider looking at other interventions and policy measures to improve access and affordability, such as free menstrual products in schools or distribution schemes for low-income households and homeless people.

Taxes on menstrual products are unfair and gender-discriminatory because these products are basic necessities. Yes, there are other products that should be considered basic necessities and should be tax exempt too. Among them are items used by males. But that is another conversation which shouldn’t derail governments from taking action on period taxes now.

Campaign tip: Be open but insist that it is time to scrap period taxes, even if there are other products that require tax revisions. That is another conversation.

Absolutely. We recognise that not all women menstruate, and not all people who menstruate are women. We use the term 'women and girls' to refer to all people who menstruate.